Investment intelligence for Japanese equities, built from regulatory filings.

Activist signals, governance catalysts, and overlooked value. Sourced from EDINET filings across the full TOPIX universe. For those doing the work on Japanese companies.

250,000+

filings processed

3,800+

companies tracked

12,000+

cross-shareholding relationships mapped

1,400+

activist accumulations flagged

01

Catalyst monitoring across the full filing universe. Activist accumulations, treasury stock buybacks, cross-shareholding unwinds, and extraordinary disclosures. Tracked as filed, not after they make the news.

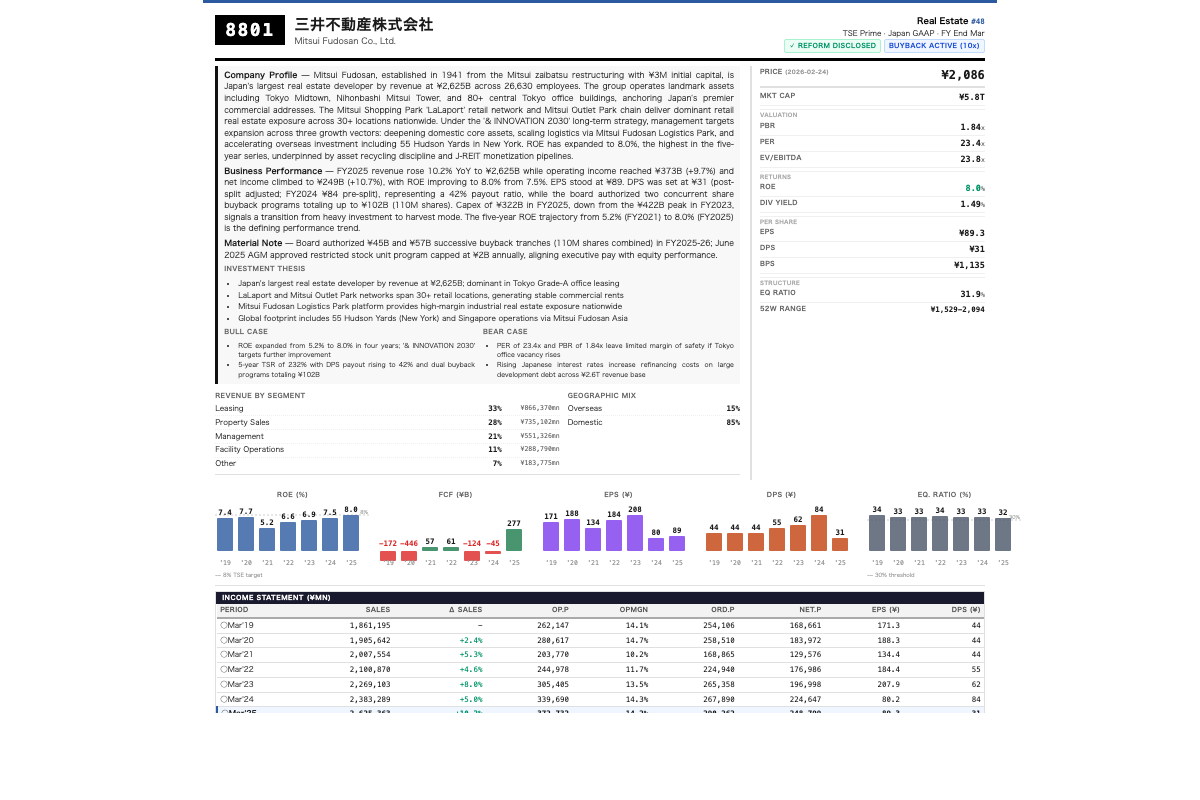

02

Company research from primary data. Factsheets built from filings. Financials, ownership structure, governance signals, and material events. Structured for investment decisions.

03

Open source tools for Japanese disclosure data. edinet-tools, a Python SDK for accessing and parsing EDINET filings, is freely available on PyPI.

Get the briefing

Periodic coverage of Japanese equity catalysts. Activist accumulations, governance shifts, overlooked situations. Written by the founder.